bkinfo-379.site

News

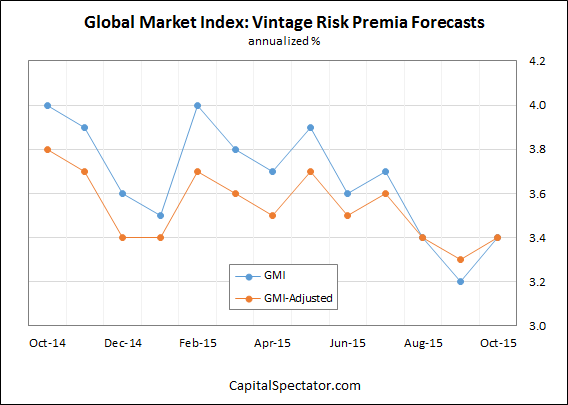

Gmi Stock Price

General Mills Inc. · AT CLOSE PM EDT 09/11/24 · USD · % · Volume3,, Get the latest General Mills Inc. (GIS) stock price, news, buy or sell recommendation, and investing advice from Wall Street professionals. 23 minutes ago. See the latest General Mills Inc stock price (GIS:XNYS), related news, valuation, dividends and more to help you make your investing decisions. View General Mills, Inc. GIS stock quote prices, financial information, real-time forecasts, and company news from CNN. Over the last 12 months, its price rose by percent. Looking ahead, we forecast General Mills to be priced at by the end of this quarter and at The General Mills Inc stock price today is What Is the Stock Symbol for General Mills Inc? The stock ticker symbol for General Mills Inc is GIS. Is GIS. General Mills, Inc. engages in the manufacture and marketing of branded consumer foods sold through retail stores. Chart ; June 05, , $ ; June 04, , $ ; June 03, , $ ; May 31, , $ General Mills Inc. · AT CLOSE PM EDT 09/11/24 · USD · % · Volume3,, Get the latest General Mills Inc. (GIS) stock price, news, buy or sell recommendation, and investing advice from Wall Street professionals. 23 minutes ago. See the latest General Mills Inc stock price (GIS:XNYS), related news, valuation, dividends and more to help you make your investing decisions. View General Mills, Inc. GIS stock quote prices, financial information, real-time forecasts, and company news from CNN. Over the last 12 months, its price rose by percent. Looking ahead, we forecast General Mills to be priced at by the end of this quarter and at The General Mills Inc stock price today is What Is the Stock Symbol for General Mills Inc? The stock ticker symbol for General Mills Inc is GIS. Is GIS. General Mills, Inc. engages in the manufacture and marketing of branded consumer foods sold through retail stores. Chart ; June 05, , $ ; June 04, , $ ; June 03, , $ ; May 31, , $

General Mills Inc. historical stock charts and prices, analyst ratings, financials, and today's real-time GIS stock price. General Mills · Open. · Previous Close. · High. · Low. · 52 Week High. · 52 Week Low. · Beta. · TTM EPS Trend. (--). General Mills, Inc.'s stock symbol is GIS and currently trades under NYSE. It's current price per share is approximately $ How much is General Mills's stock price per share? (NYSE: GIS) General Mills stock price per share is $ today (as of Aug 30, ). · What is General. Find the latest GMI Technology Inc. (TW) stock quote, history, news and Price/Sales (ttm). Price/Book (mrq). Enterprise Value/Revenue. Get Groupe Minoteries SA (gmi.s) real-time stock quotes, news, price and financial information from Reuters to inform your trading and investments. General Mills, Inc. Common Stock (GIS) Historical Quotes. 1M 6M YTD 1Y 5Y MAX. Download historical data. Date. Close/Last. Volume. Open. High. Discover real-time General Mills, Inc. Common Stock (GIS) stock prices, quotes, historical data, news, and Insights for informed trading and investment. General Mills, Inc. (bkinfo-379.site): Stock quote, stock chart, quotes, analysis, advice, financials and news for Stock General Mills, Inc. | Nyse: GIS | Nyse. Analyst Forecast. According to 16 analysts, the average rating for GIS stock is "Hold." The month stock price forecast is $, which is a decrease of -. General Shareholder Information: Investor Relations Department or [email protected] The G.M.I Technology Inc stock price today is What Is the Stock Symbol for G.M.I Technology Inc? The stock ticker symbol for G.M.I Technology Inc is The 76 analysts offering price forecasts for General Mills have a median target of , with a high estimate of and a low estimate of Stock analysis for General Mills Inc (GIS:New York) including stock price, stock chart, company news, key statistics, fundamentals and company profile. The current price of GIS is USD — it has decreased by −% in the past 24 hours. Watch General Mills, Inc. stock price performance more closely on the. General Mills Inc. ; Open. $ Previous Close$ ; YTD Change. %. 12 Month Change. % ; Day Range · 52 Wk Range - Stock Activity ; Open: ; Day Low: ; Day High: ; 52 Wk Low: ; 52 Wk High: GISNew York Stock Exchange • NLS real time price • USD. GENERAL MILLS, INC. (GIS). at close. (%). Summary Financials Analysis Earnings. General Mills (GIS) · Barchart Technical Opinion · Business Summary · GIS Related ETFs · GIS Related stocks · Key Turning Points. GMI | Complete Green Mining Innovation Inc. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview.

How To Determine Federal Tax Bracket

Federal income tax rates ; 12%, $10, to $41,, $14, to $55, ; 22%, $41, to $89,, $55, to $89, ; 24%, $89, to $,, $89, to. Individual income tax brackets and rates; Tax Commissioner; duties; tax tables; other taxes; tax rate ; 1, $,, $, ; 2, $2,, $4, The taxable income is then multiplied by the tax bracket rate that applies, giving you the federal tax owed. • Federal tax owed is then reduced by the total. Calculate your total taxable income without long-term capital gains. Use this amount to determine the rate for your long-term gain, up to the top of the bracket. Beginning in Tax Year , taxpayers will see changes to filing statuses, tax brackets, and the calculation of Montana taxable income. Effective Tax Rate = Total Tax ÷ Taxable Income. Effective Tax Rate vs. Marginal Tax Rate. While an effective tax rate represents the percentage of your taxable. You can determine what your effective tax rate is by dividing your total tax by your taxable income on your federal tax return. On Form , divide the figure. Marginal tax rate definition: How do tax brackets work? · The first $11, of your income is taxed at the 10% rate. · The next $33, of your income (i.e., the. Estimate your federal income tax withholding · See how your refund, take-home pay or tax due are affected by withholding amount · Choose an estimated withholding. Federal income tax rates ; 12%, $10, to $41,, $14, to $55, ; 22%, $41, to $89,, $55, to $89, ; 24%, $89, to $,, $89, to. Individual income tax brackets and rates; Tax Commissioner; duties; tax tables; other taxes; tax rate ; 1, $,, $, ; 2, $2,, $4, The taxable income is then multiplied by the tax bracket rate that applies, giving you the federal tax owed. • Federal tax owed is then reduced by the total. Calculate your total taxable income without long-term capital gains. Use this amount to determine the rate for your long-term gain, up to the top of the bracket. Beginning in Tax Year , taxpayers will see changes to filing statuses, tax brackets, and the calculation of Montana taxable income. Effective Tax Rate = Total Tax ÷ Taxable Income. Effective Tax Rate vs. Marginal Tax Rate. While an effective tax rate represents the percentage of your taxable. You can determine what your effective tax rate is by dividing your total tax by your taxable income on your federal tax return. On Form , divide the figure. Marginal tax rate definition: How do tax brackets work? · The first $11, of your income is taxed at the 10% rate. · The next $33, of your income (i.e., the. Estimate your federal income tax withholding · See how your refund, take-home pay or tax due are affected by withholding amount · Choose an estimated withholding.

Federal Tax Brackets This puts you in the 25% tax bracket, since that's the highest rate applied to any of your income; but as a percentage of the whole. Your federal tax rates are based on your income level and filing status. The percentages and income brackets can change annually. If the result is zero or less, enter “0.” Utah has a single tax rate for all income levels, as follows: Date Range, Tax Rate. January 1, In , there are seven federal tax brackets: 10%, 12%, 22%, 24%, 32%, 35% and 37%. The bracket depends on taxable income and filing status. How to calculate your income taxes: Know the difference between your average and marginal tax bracket. In Canada, the more you make, the more tax you may owe. Your federal taxable income is the starting point in determining your state Income Tax liability. Individual Income Tax rates range from 0% to a top rate of. Federal income tax is calculated using a progressive tax structure, meaning that your effective tax rate is lower than your income tax bracket. In actuality, income is taxed in tiers. When your income reaches a different tier, that portion of your income is taxed at a new rate. Your marginal tax rate or. The United States federal government and most state governments impose an income tax. They are determined by applying a tax rate, which may increase as. Once you've found your taxable income, you can calculate your federal income tax. But remember, your entire income isn't taxed at the rate corresponding to your. The average tax rate is the total tax paid divided by the total income earned. A 10 percent marginal tax rate means that 10 cents of every next dollar earned. Each tax rate applies only to income in a specific tax bracket. Thus, if a taxpayer earns enough to reach a new bracket with a higher tax rate, his or her total. The local income tax is calculated as a percentage of your taxable income. Local officials set the rates, which range between % and % for the current. Federal income tax is calculated using a progressive tax structure, meaning that your effective tax rate is lower than your income tax bracket. Why? As this. Find out how much you'll pay in federal income taxes. This is the percentage paid in Federal taxes on additional income. To determine your marginal tax rate, the tool recalculates your total Federal income tax. Joe will pay $1,, or 10%, on the first $10, in income and then $3, on the next $31, in income ([$41, - $10, = $31,] x 12% = $3,). So. Income Tax Rate By State ; Wyoming, $ 62,, %, 1 ; North Dakota, $ 61,, %, To calculate your effective tax rate, take the total amount of tax you paid and divide that number by your taxable income. Your effective tax rate will be much. Your final taxable income determines your tax bracket and tax rate. But all of your income isn't taxed at one flat rate. Instead, it's taxed in a graduated.

How To Add A Job Alert On Linkedin

Troubleshoot job alerts · Your settings won't allow any LinkedIn emails to be sent to your email address. · We're not able to create an email alert due to the use. LinkedIn's CEO noted the following three bkinfo-379.site your profile up to bkinfo-379.site to follow companies on bkinfo-379.site use linkedin job alerts. On the job search results page, locate the 'Set alert' toggle at the top left and switch it to 'On' to create a job alert based on your current search criteria. Find a company that matches your field of interest · Click on their LinkedIn company page and select the 'Jobs' button located on the left · Tap on the 'Create a. If you already have an account - Welcome back! Please login to manage your job alerts and keep track of your saved jobs. Sign in with LinkedIn. To set up LinkedIn job alerts hit 'set alert' at the top of your search result list. This will save that particular search. You can set up more than one job. Step 1: Update Your Profile · Step 2: Define Your Job Preferences · Step 3: Set Up Job Alerts · Step 4: Refine Your Search · Step 5: Save Your. Create a Profile: Once you have chosen a website or platform, you will need to create a profile. This typically involves providing some basic. A Step-by-Step Guide to Setting Job Alerts on LinkedIn · Step 1: Update Your Profile · Step 2: Define Your Job Preferences · Step 3: Set Up Job. Troubleshoot job alerts · Your settings won't allow any LinkedIn emails to be sent to your email address. · We're not able to create an email alert due to the use. LinkedIn's CEO noted the following three bkinfo-379.site your profile up to bkinfo-379.site to follow companies on bkinfo-379.site use linkedin job alerts. On the job search results page, locate the 'Set alert' toggle at the top left and switch it to 'On' to create a job alert based on your current search criteria. Find a company that matches your field of interest · Click on their LinkedIn company page and select the 'Jobs' button located on the left · Tap on the 'Create a. If you already have an account - Welcome back! Please login to manage your job alerts and keep track of your saved jobs. Sign in with LinkedIn. To set up LinkedIn job alerts hit 'set alert' at the top of your search result list. This will save that particular search. You can set up more than one job. Step 1: Update Your Profile · Step 2: Define Your Job Preferences · Step 3: Set Up Job Alerts · Step 4: Refine Your Search · Step 5: Save Your. Create a Profile: Once you have chosen a website or platform, you will need to create a profile. This typically involves providing some basic. A Step-by-Step Guide to Setting Job Alerts on LinkedIn · Step 1: Update Your Profile · Step 2: Define Your Job Preferences · Step 3: Set Up Job.

Is there something similar available currently? – Yost Commented Jan 2 at Add a comment. Activate Job Alert Notification · In the Setup and Maintenance work area, go to: Offering: Recruiting and Candidate Experience · On the Recruiting Content Library. You will be able to add more details about your profile. In doing this, it allows our recruiters to contact you in case there is a match to a vacancy with your. How to unsubscribe from a saved search email notification USAJOBS is a Opens in a new windowUnited States Office of Personnel Management website. LinkedIn. To set a job alert, toggle the “Job Alert” switch from off to on. The switch is located at the top of the list of job postings, just beneath the list of. Log on to the career site · Select Job Alerts in the header · Click Create Job Alert · Name your Alert · Select Frequency of Daily or Weekly · Select Job Type(s). Every Job Alert email has a link at the bottom of the email that says 'unsubscribe'. Click the link to cancel the alert. There are two ways to set up a job alert on LinkedIn: by company or by position. A job alert that is set for a company will let you know when. Go to the career site, and either create a Candidate Profile or Log In. · Go to Job Management tab > Saved Searches/Alerts · Click on "Create New Job Alert". Place a check in the box next to each job category for which you would like to receive email notifications, then click the 'Subscribe' button and fill out. Click the Jobs icon at the top of your LinkedIn homepage. · Click Manage alerts under the search box at the top of the page. · You can edit or. Did you know you can set up a maximum of 20 job alerts? I'm often told by people that they set up job alerts on LinkedIn and then get back. Click the Jobs icon at the top of your LinkedIn homepage. · Follow the path Jobs > Preferences > Job alerts. · In the Job alerts pop-up, you can edit or delete. How to Set up Job Alerts on LinkedIn · Click on Jobs (top RH side) · Click on Job Alerts. The first step is to Open LinkedIn and Click the Jobs icon at the top of your LinkedIn homepage.. Click Job alerts.. Click the edit icon beside the alert. Click Off to disable. Click Save or click Cancel to go back without saving your changes. To unsubscribe from LinkedIn Jobs email notifications: Open the email. loading. LinkedIn · Facebook · Instagram · Twitter · Login · Register · Extension Recruiting Toggle navigation. Find Your Job Create a job alert and add a few. Here's how to set up a job alert on LinkedIn. so even if you're not online. you can still be notified when new jobs are posted. First, switch the Set alert toggle to On at the top left of the job search results page. Doing this will help you to create a job alert for your current search. Setting up job alerts on LinkedIn is a convenient way to stay updated on new job opportunities that match your preferences. By creating job alerts, you can.

Christmas Club Bank Account

$10 minimum deposit to open the account. · No monthly service fee. · No deadline to open the Christmas Club account. · Interest earned on the daily balance and. Southern Bank offers a savings account option for those wanting to plan ahead and save for Christmas. Set aside funds year-round for the upcoming holiday. Minimum opening deposit is $5 · The current rate is variable and subject to change · The account will mature on October 31 · A minimum balance of $5 is required. A Christmas club is a special-purpose savings account, first offered by various banks and credit unions in the United States beginning in the early 20th. Best for: Club accounts are best for a specific savings goal, while regular savings accounts are an excellent way to protect your money and earn interest over. CB&S Bank's Christmas Club Savings Account can help you have a worry-free holiday season by saving all throughout the year. Join our Christmas Savings Club! You'll have an account with tiered interest that can motivate you to put away money January through December. Save all year and access your funds in November! Open Now Request a Call Back Account Features Earn a Higher Interest Rate Only $25 Opening Deposit No. Christmas Club · $20 minimum amount to open · Build up balance with regular deposits and automatic transfers from checking or savings · No monthly service. $10 minimum deposit to open the account. · No monthly service fee. · No deadline to open the Christmas Club account. · Interest earned on the daily balance and. Southern Bank offers a savings account option for those wanting to plan ahead and save for Christmas. Set aside funds year-round for the upcoming holiday. Minimum opening deposit is $5 · The current rate is variable and subject to change · The account will mature on October 31 · A minimum balance of $5 is required. A Christmas club is a special-purpose savings account, first offered by various banks and credit unions in the United States beginning in the early 20th. Best for: Club accounts are best for a specific savings goal, while regular savings accounts are an excellent way to protect your money and earn interest over. CB&S Bank's Christmas Club Savings Account can help you have a worry-free holiday season by saving all throughout the year. Join our Christmas Savings Club! You'll have an account with tiered interest that can motivate you to put away money January through December. Save all year and access your funds in November! Open Now Request a Call Back Account Features Earn a Higher Interest Rate Only $25 Opening Deposit No. Christmas Club · $20 minimum amount to open · Build up balance with regular deposits and automatic transfers from checking or savings · No monthly service.

The Christmas Club account is a great way to save money during the year for holiday or other expenses. You can open your account today with a $10 deposit. A. Use payroll deduction to make depositing easy · On November 1st each year, we automatically move the balance to your checking or savings account. A pre-notice. Open a Christmas Club Account with an opening deposit that matches your weekly payments: $, $, $, $, or $ Payments can be made with a. A Christmas club account is a savings account offered by many banks and credit unions. You typically open the account at the beginning of the calendar year. Turn your savings account into Santa's workshop. With only a $25 initial deposit and no monthly service charge you can start to build savings. During the year, make weekly deposits into your Christmas Club Account. With this interest bearing account, you'll be earning money while you save for the. Keep track of your progress toward a specific goal, using it like a traditional Vacation Club or Christmas Club account · No early withdrawal penalties for non-. Save all year leading up to Christmas spending · Setup automatic transfer from your checking account · $ minimum balance to earn dividends · Manage your account. Our Christmas Club Savings Account allows you to save up for the holiday season while earning interest with no monthly fees. Community Bank checking account with draft to Christmas Club Account. Limit two accounts per customer. Fees may reduce earnings. All funds are paid out at the. Open a Christmas Club saving account to save for the holidays, a vacation or any major expense. Bank online or on the go with free online and mobile banking. With Georgia United's Christmas Club savings account, you can start saving now for your holiday season. Take the budgeting guesswork out of your plans while. Open a Christmas Club saving account to save for the holidays, a vacation or any major expense. Bank online or on the go with free online and mobile. Ease the hustle and bustle of the holiday season with a Christmas Club account. You can save for an entire year to cover your holiday expenses. An American Bank & Trust Christmas Club account is a great way to save for your holiday expenses. This account offers an affordable savings method. A Christmas Club account, also known as a Carefree Savings account, is a savings account. You can open this type of account anytime during the year. By opening. Save for Christmas all year long with an F&M Christmas Club savings account. See why we are one of California's strongest banks! No monthly fees · No monthly fees · Funds deposited to your checking account each November · Funds deposited to your checking account each November · Earns interest. Easy, everyday account access. Unlock financial simplicity with our online services. Enjoy the ability to check balances, make transfers, pay bills and more. This account helps you save year-round so holiday expenses don't stress you out when it's time to start making a list and checking it twice.

Best Home Shredders Under $100

31 results ; Fellowes Powershred Sheet Cross-Cut Paper Shredder - White ; Powershred 12 Sheet Micro-Cut Paper Shredder - Fellowes. Powershred PC 6 Sheet Cross-Cut Paper Shredder. $normal price$ Save $ Good through After comparing four of the latest paper shredders from the top manufacturers, I've found that the best paper shredder under $ is the Amazon Basics AUXB. Royal 12 Sheet Cross-cut 3/4 HP Shredder. PX (24) · $ ; Royal 8 Page Cross-Cut Shredder. ST80X. (21) · $ ; Royal 5 Sheet Shredder. Pay $ after $50 OFF your total qualifying purchase upon opening a new card. info. Apply for a Home Depot Consumer Card. Keep your data secure by choosing the right paper shredder. With a wide assortment of the best paper shredders, GBC is sure to have the perfect one for you. Explore powerful paper shredders that can fully break down multiple pages, discs, magazines and more. Low-priced, high powered paper shredders available at. According to our Customers, These are the Best Shredders For Office & Personal Use. Fellowes AutoMax M Sheet Micro-Cut Commercial Shredder (). Bonsaii 8-Sheet Cross Cut Paper Shredder CC for Home Office Use · Bonsaii Sheet Cross Cut Paper Shredder CA with Gallon Wastebasket · Bonsaii 31 results ; Fellowes Powershred Sheet Cross-Cut Paper Shredder - White ; Powershred 12 Sheet Micro-Cut Paper Shredder - Fellowes. Powershred PC 6 Sheet Cross-Cut Paper Shredder. $normal price$ Save $ Good through After comparing four of the latest paper shredders from the top manufacturers, I've found that the best paper shredder under $ is the Amazon Basics AUXB. Royal 12 Sheet Cross-cut 3/4 HP Shredder. PX (24) · $ ; Royal 8 Page Cross-Cut Shredder. ST80X. (21) · $ ; Royal 5 Sheet Shredder. Pay $ after $50 OFF your total qualifying purchase upon opening a new card. info. Apply for a Home Depot Consumer Card. Keep your data secure by choosing the right paper shredder. With a wide assortment of the best paper shredders, GBC is sure to have the perfect one for you. Explore powerful paper shredders that can fully break down multiple pages, discs, magazines and more. Low-priced, high powered paper shredders available at. According to our Customers, These are the Best Shredders For Office & Personal Use. Fellowes AutoMax M Sheet Micro-Cut Commercial Shredder (). Bonsaii 8-Sheet Cross Cut Paper Shredder CC for Home Office Use · Bonsaii Sheet Cross Cut Paper Shredder CA with Gallon Wastebasket · Bonsaii

Home, Industrial/Commercial or Office Shredders in Various Cut Styles · gallon Bin Cross-cut Shredder (1) · 6-gallon Bin Cross-cut Shredder (1) · Light Duty. What are the Best Shredders for Office & Personal Use at Staples? · HSM Securio B32c Sheet Cross-Cut Commercial Shredder () · ideal P-4 Security Find a selection of high-quality Paper Shredders at Costco Business Center for delivery to your business Best Sellers. Grid View. List View. Showing of 7. Call today for the best prices. The Largest Selection of Industrial and Commercial Paper Shredders. We build to order and offer in house leasing. Shop paper shredders for the home or office. Find microcut or cross cut shredders to securely dispose of your sensitive information. All · Images · Videos · Maps · News; Shopping; Flights · Travel · Hotels · Real Estate · My Bing · Paper Shredders on Sale · Best Paper Shredders. Wireless Connectivity ; $ Berkley Jensen 10 Sheet Microcut Shredder. Berkley Jensen 10 Sheet Microcut Shredder. (35) ; $ · Royal 20 Sheet Microcut. Today, a consumer cross-cut paper shredder is pretty cheap (like $) Or just call Iron Mountain and an wheeler mobile shredder will show. SKU: GBC Shredder Oil, For SelfOil TAA Compliant Shredders, 1 Liter. Price $ 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, SKU: WSM GBC Momentum. Paper Shredders Shredder Cut Style Cross-cut. Cross-cut ; Paper Shredders Shredder Cut Style Micro-cut. Micro-cut ; Paper Shredders Price $50 - $ Price: $50 -. If you're in the U.S., Staples has their own brand of shredders designed for home use. Fellowes is probably the best-known brand and they're. BONSEN personal paper shredder delivers high quality shredding performance for all your confidential documents. Best paper shredders for individual users. Wireless Connectivity ; $ Berkley Jensen 10 Sheet Microcut Shredder. Berkley Jensen 10 Sheet Microcut Shredder. (35) ; $ · Royal 20 Sheet Microcut. Fellowes® Powershred® LX % Jam Proof Sheet Cross-Cut Paper Shredder, Item # (45). The best strip-cut paper shredders can process up to 60 feet of paper per minute, making them an excellent choice for busy workplaces. Home, Industrial/Commercial or Office Shredders in Various Cut Styles · gallon Bin Cross-cut Shredder (1) · 6-gallon Bin Cross-cut Shredder (1) · Light Duty. Paper Shredders ; Trusted by London Drugs 6 Sheet Cross-Cut Shredder - AUXA-TR. $54 · (6) ; Trusted by London Drugs 4 Sheet Cross-Cut Shredder - ASC-TR. $ Auto Feed Shredders ; OfficeAssist™ Auto Feed Shredder AHS Anti-Jam Micro Cut. Best for Large Office · Bin Capacity in Sheets: 1, ; OfficeAssist™ Auto Feed. The best strip-cut paper shredders can process up to 60 feet of paper per minute, making them an excellent choice for busy workplaces. Can anyone recommend a good paper shredder that works well for cardboard? I have the idea that I can grow the worms into a little side business of selling.

Different Forms Of Passive Income

Investing in dividend-paying stocks can be another lucrative passive income idea. Owning these stocks means you become a shareholder of the company. Passive income is generated through investments, rental properties, and other means of earning income with little or no effort on your part. There are many. Passive income is income generated passively with little or no input or work after the initial input. It continues to generate wealth after the. If you are interested in passive investment opportunities other than real estate, you can also research the many ways to invest in traditional equities such as. You can earn passive income by renting out property, through dividend stocks or a high-yield savings account. Passive income is income typically generated through sources other than a direct employer or contractor. It can usually be earned through three methods. Real estate has the potential to provide passive income in a couple of different ways: Real estate investment trusts (REITs): REITs are publicly-traded. From rental income to dividend stocks, passive income is a great way to earn money while you sleep. Passive or unearned income could come from rental properties, royalties and limited partnerships. Portfolio or investment income includes interest, dividends. Investing in dividend-paying stocks can be another lucrative passive income idea. Owning these stocks means you become a shareholder of the company. Passive income is generated through investments, rental properties, and other means of earning income with little or no effort on your part. There are many. Passive income is income generated passively with little or no input or work after the initial input. It continues to generate wealth after the. If you are interested in passive investment opportunities other than real estate, you can also research the many ways to invest in traditional equities such as. You can earn passive income by renting out property, through dividend stocks or a high-yield savings account. Passive income is income typically generated through sources other than a direct employer or contractor. It can usually be earned through three methods. Real estate has the potential to provide passive income in a couple of different ways: Real estate investment trusts (REITs): REITs are publicly-traded. From rental income to dividend stocks, passive income is a great way to earn money while you sleep. Passive or unearned income could come from rental properties, royalties and limited partnerships. Portfolio or investment income includes interest, dividends.

From rental income to dividend stocks, passive income is a great way to earn money while you sleep. There are many different types of passive income sources, such as This article will talk about five different forms of passive income. Make a. Many course creators start as online coaches. The coaching industry is one of the fastest-growing ways to earn money online. In , the life coaching industry. 25 Ways To Make Passive Income in · Rent all or part of your property · Store stuff for people · Rent out items for people to use · Bonds and bond funds · Put. High-interest savings accounts, investing in business, P2P lending, and rental properties are some ways to generate passive income. High-interest savings accounts, investing in business, P2P lending, and rental properties are some ways to generate passive income. There are two fundamental forms of passive income, Entrepreneurial (e.g. affiliate marketing, app development and content creation) and Financial (e.g. dividend. Other ways to earn passive income · Peer-to-peer lending · Sell ad space · Content creation. 6. Software as a Service (SaaS) business. Another potentially lucrative option for passive income is to create an app or software that you can offer as a. It is an exciting time to delve into the world of residual income. The internet has exploded with countless opportunities from self-publishing books to online. Most people keep many things in their homes, and they are always on the lookout for cheap ways to house them. There's nothing easier than being paid to keep. You can earn it by investing, renting various assets out to others, leveraging advertising opportunities, or just monetizing the knowledge and skills you. Real estate has the potential to provide passive income in a couple of different ways: Real estate investment trusts (REITs): REITs are publicly-traded. Rental Income: If you own a property and collect rent, that's a passive income source. · Stocks: Owning stocks or preferred shares in a company is a proven way. Real estate investment trusts, or REITs, are another form of passive real estate investing. REITs are shares of real estate companies that can be purchased and. REITs, or real estate investment trusts, are companies that buy and rent commercial properties. Like stocks, many REITs are publicly traded. Also like stocks. Passive income for retirement are income sources that you benefit from without too much effort – the money just flows in (or, you enjoy earning it). How to build wealth with passive income · 1. Renting out your home or other property · 2. Renting or selling household items · 3. Affiliate marketing · 4. Use your. Other ways to earn passive income · Peer-to-peer lending · Sell ad space · Content creation. This income could be in the form of royalties from a book published years ago or stock dividends based on investments from the past. Some recipients of passive.

Irs Jobs Pay

IRS? Job Descriptions Join us for a career with purpose. Featured Jobs. © UNITED STATES INTERNAL REVENUE SERVICE IRS Privacy Policy Chat. Apply for IRS EZ. Do you need to apply for a tax exemption under Section (c)(3) of the Internal Revenue Code? Apply. How much does IRS pay? The average IRS salary ranges from approximately $39, per year (estimate) for an APPOINTMENT CLERK to $, per year (estimate) for. The pay averages from $58, – $87, per year and positions are available in the different IRS offices around the country, but the majority are in the. The federal minimum wage for covered nonexempt employees is $ per hour. Many states also have minimum wage laws. In cases where an employee is subject. This commentary defines reasonable compensation, introduces the IRS Job Aid and Appendix, provides links to some recent IRS papers related to reasonable. How Much Do Irs Agent Jobs Pay per Year? · $20, - $29, 11% of jobs · $37, is the 25th percentile. Salaries below this are outliers. · $40, - $49, The average employee salary for the Internal Revenue Service (IRS) in was $ There are employee records for IRS. The average IRS salary ranges from approximately $ per year for Customer Service Representative to $ per year for Senior Economist. IRS? Job Descriptions Join us for a career with purpose. Featured Jobs. © UNITED STATES INTERNAL REVENUE SERVICE IRS Privacy Policy Chat. Apply for IRS EZ. Do you need to apply for a tax exemption under Section (c)(3) of the Internal Revenue Code? Apply. How much does IRS pay? The average IRS salary ranges from approximately $39, per year (estimate) for an APPOINTMENT CLERK to $, per year (estimate) for. The pay averages from $58, – $87, per year and positions are available in the different IRS offices around the country, but the majority are in the. The federal minimum wage for covered nonexempt employees is $ per hour. Many states also have minimum wage laws. In cases where an employee is subject. This commentary defines reasonable compensation, introduces the IRS Job Aid and Appendix, provides links to some recent IRS papers related to reasonable. How Much Do Irs Agent Jobs Pay per Year? · $20, - $29, 11% of jobs · $37, is the 25th percentile. Salaries below this are outliers. · $40, - $49, The average employee salary for the Internal Revenue Service (IRS) in was $ There are employee records for IRS. The average IRS salary ranges from approximately $ per year for Customer Service Representative to $ per year for Senior Economist.

The Office of Personnel Management provides policy leadership and expertise on a variety of Governmentwide pay programs for Federal employees. Working as an IRS officer in the US government has many benefits, some of which include a competitive salary and benefits package, job security. Find remote work from home jobs and careers with Internal Revenue Service - IRS income tax to pay expenses accrued during the Civil War. Ten years later. If you sign off on a reasonable compensation number that the IRS later deems unreasonable, you can face preparer penalties of $5, or more! Average IRS hourly pay ranges from approximately $ per hour for Janitor to $ per hour for Customer Service Representative. Salary information comes. Special agents for the IRS investigate violations of the Internal Revenue Code and other financial crimes. The IRS special agent salary is based on the. Join the IRS for a wide variety of career opportunities – from accounting to customer service to engineering to IT to architect and graphic design positions. Ensuring that the minority who are unwilling to comply pay their fair share. Hiring Needs within the IRS. IRS employees work in numerous types of jobs. The. Employee Relations · Re-Entry Guidance · Re-Entry Toolkit · Human Resources bkinfo-379.site / Policy / Pay & Leave / Salaries & Wages. Skip to main content. In. United States Internal Revenue Service IRS · Year · Employer · Name Last Name (Optional First Name with no comma) · Annual Wages $18,$,$18,$, Internal Revenue Agent (Examiner) - DIRECT HIRE (12 Month Register) AMENDED · Starting at $98, Per Year (GS 13) · Permanent • Full-time · This job is. As federal government employees, all professionals working within the IRS are paid under the General Schedule (GS), which ranges between GS-1 and GS The pay begins with a GS-1, which is $ to $ per year or $ to $ per hour. The employee's wages can increase 15 grades. A GS-5 is $29, to. A new IRS CI agent hired at Grade 7 step 1 from Miami, will get a total pay of 70, (56,*). LEO Pay scales: Law Enforcement. The highest reported pay for the federal agency was $, The View the top highest paid employees for the Internal Revenue Service (IRS) below. job, with job requirements, a salary and insurance and rules and regulations. My wife was with IRS for many years, as a Revenue Agent. Much. Pay. The median annual wage for tax examiners and collectors, and revenue agents was $58, in May Job Outlook. Employment of tax examiners and. Locality Pay Tables for Geographic Areas. Pay Table, Annual Rate, Hourly Rate, XML Data. Albany-Schenectady, NY-MA. If an individual is an employee who is paid commissions by the employer, the employer withholds the taxes and pays the IRS. · If the individual is a self-.

Insurance Companies That Accept Permits

Here's How to Locate Cheap Car Insurance for Permit Drivers - Insurance Companies That Accept Permits. How to Get the Best Rate (In a Nutshell). insurance applies whether or not you're at fault for the car accident. What Factors Does New York Law Allow in Determining Your Premiums? Car insurance. Drivers with a learner's permit must have auto insurance. Find out the best way to cover permit drivers. Insurance companies in California are required by law (California Vehicle If DMV does not receive proof of insurance for a vehicle, we will suspend. Most auto insurance companies allow first-time drivers with permits to be added to the plan of a parent or significant other. Once they become a licensed. Usually, car insurance companies won't communicate what discounts they offer So make sure you fully understand what is and isn't accepted by your insurance. permit(IPD); Get car insurance (required in most states). Please note, if you plan to stay long-term, you need to get a U.S. driver's license in the state you. Illinois law requires you to have insurance before you drive. After you pay for your policy, your insurance company will send you an insurance card that you. Get the right car insurance for drivers with a learners permit. Prepare your car and insurance policy for a new driver and learn how to save on coverage. Here's How to Locate Cheap Car Insurance for Permit Drivers - Insurance Companies That Accept Permits. How to Get the Best Rate (In a Nutshell). insurance applies whether or not you're at fault for the car accident. What Factors Does New York Law Allow in Determining Your Premiums? Car insurance. Drivers with a learner's permit must have auto insurance. Find out the best way to cover permit drivers. Insurance companies in California are required by law (California Vehicle If DMV does not receive proof of insurance for a vehicle, we will suspend. Most auto insurance companies allow first-time drivers with permits to be added to the plan of a parent or significant other. Once they become a licensed. Usually, car insurance companies won't communicate what discounts they offer So make sure you fully understand what is and isn't accepted by your insurance. permit(IPD); Get car insurance (required in most states). Please note, if you plan to stay long-term, you need to get a U.S. driver's license in the state you. Illinois law requires you to have insurance before you drive. After you pay for your policy, your insurance company will send you an insurance card that you. Get the right car insurance for drivers with a learners permit. Prepare your car and insurance policy for a new driver and learn how to save on coverage.

Driver Licenses And Permits; Mandatory Insurance. Skip to main content. On You will receive this card from your auto insurance company when you buy a. After the monitoring period, drivers who demonstrate safe driving habits can receive a discount that exceeds 10%. Join the ,+ teen drivers that have. From licensing to insurance, we'll help cover some questions you may have around Canadian car insurance for international drivers. When your teen is ready for a learner's permit, you'll need to know about requirements for adding him to your car insurance policy. Yes, you can get car insurance with a permit in California if your vehicle is registered in your name and the insurer allows it. Yes, you can get car insurance with a permit in California if your vehicle is registered in your name and the insurer allows it. Most insurance companies will not directly insure a driver who has a permit, but if you live with parents or other people who have auto insurance, you may be. On the other hand, if you do not admit fault, then it can be difficult to prove who was at fault. What are the best ways to make sure your insurance company. This could mean we did not receive a response from the registered owner within the (15) days response time or the insurance company did not respond to our. If you own your own vehicle and live with your parents, or are away at school, check with your parents' insurance company to see if your vehicle can be covered. About Us. Mercury Insurance was founded in by George Joseph on the idea that consumers should receive high-quality insurance products and top-notch. So, you may need to purchase car insurance for a driver under 18, or someone with their learner's permit, even if you won't be driving the motor vehicle. Yes, it's possible to get a policy with only a learner's permit, usually you will need to be able to get a driver's license within 30 to 45 days. Vehicle owners shown to have been without insurance will receive notices This is because the insurance company is not required to send the Division. The first time you register your vehicle in this state, and each time your registration is renewed, you must provide the name of your insurance company. Know. Please be aware that many insurers consider your credit history in the underwriting process, with regard to accepting or rejecting your application, or in the. Your teenage child just got their learner's permit and will receive other performance, profitability or volume-based compensation from the insurers. Many companies allow a teen with a learner's permit to be listed on the policy at no charge until he or she becomes a licensed driver. Permit drivers should also be listed even though they will not have impact Honor Roll in a given semester. Can a learner driver be insured on their. You'll be covered by your parents' or instructor's insurance while practicing with your permit, so you won't need insurance of your own until you get your.

Interest Rate Based On Credit Score

Credit card rates. Interest rates on credit cards vary across the major banks in Canada, but typically, they average at %. · Personal loan interest rates. You're more likely to pay higher interest rates on credit you do get. Some insurance companies also use credit report information, along with other factors, to. The average APR for someone with a credit score is currently % for a new car, and % for a used car. Car Loan Interest Rates for Deep Subprime. 30 Year Fixed. 15 Year Fixed ; FICO Scores. Average NJ Rates (APR). FICO Scores ; %. ; %. ; %. The final loan amount and estimated monthly payment may vary based on your credit score and other credit qualifiers. Interest rates and program terms are. Average Credit Card Interest Rates by Category ; Excellent Credit, %, % ; Good Credit, %, % ; Fair Credit, %, % ; Secured Cards, A higher score increases a lender's confidence that you will make payments on time and may help you qualify for lower mortgage interest rates and fees. You know that bad credit means higher interest rates, which in turn, mean more money paid over the life of each loan you take out. But do you really understand. Mortgage rates as of September 9, ; % · % · % · % ; $1, · $1, · $1, · $1, Credit card rates. Interest rates on credit cards vary across the major banks in Canada, but typically, they average at %. · Personal loan interest rates. You're more likely to pay higher interest rates on credit you do get. Some insurance companies also use credit report information, along with other factors, to. The average APR for someone with a credit score is currently % for a new car, and % for a used car. Car Loan Interest Rates for Deep Subprime. 30 Year Fixed. 15 Year Fixed ; FICO Scores. Average NJ Rates (APR). FICO Scores ; %. ; %. ; %. The final loan amount and estimated monthly payment may vary based on your credit score and other credit qualifiers. Interest rates and program terms are. Average Credit Card Interest Rates by Category ; Excellent Credit, %, % ; Good Credit, %, % ; Fair Credit, %, % ; Secured Cards, A higher score increases a lender's confidence that you will make payments on time and may help you qualify for lower mortgage interest rates and fees. You know that bad credit means higher interest rates, which in turn, mean more money paid over the life of each loan you take out. But do you really understand. Mortgage rates as of September 9, ; % · % · % · % ; $1, · $1, · $1, · $1,

A credit score is a number between and that represents a borrower's creditworthiness; the higher, the better. Good credit scores are built over time. A credit score of or above means you're extremely well-positioned to take advantage of some of the lowest interest rates. Credit card companies and lenders use credit scores as one of the factors to determine loan amounts and interest rates. Your credit score is based on your. What is the average interest rate on a loan? How much you'll pay in interest depends on a number of factors, including your credit history and credit scores. Banks set interest rates (the APR or annual percentage rate) based on the risk you pose. If you appear to be high risk, expect a higher interest rate. (Or, if. While a good credit score can help you qualify for a loan and lower interest rate, it isn't the only factor behind a mortgage offer. You have control over. VA: Financing is based on the lower middle score of each borrower. For example, if borrower 1 has a , , and and borrower 2 has a , and then. If your credit score is in the highest category, , a lender might charge you percent interest for the loan. This means a monthly payment of $ Those with a credit score of would generally be considered “non-prime.” Folks in this category are not able to access the attractive mortgage rates you. Rates in this table are based on a credit score. View full rate assumptions for this table or customize your rate based on credit. VA Loans VA Loan Rates. particularly for loans within let's say years. It serves as a sort of market benchmark for where rates will be. Lenders can then add. If your credit score is in the highest category, , a lender might charge you percent interest for the loan. This means a monthly payment of $ Credit card rates. Interest rates on credit cards vary across the major banks in Canada, but typically, they average at %. · Personal loan interest rates. A high credit score might net you an APR of % on a year, $, mortgage with a monthly payment of $1, (not including insurance or taxes). Use this tool throughout your homebuying process to see how your credit score, home price, down payment, and more can affect mortgage interest rates. Achieving a good credit score can help you qualify for a credit card or loan with a lower interest rate and better terms. That said, different lenders use their. There's no “magic credit score number” that guarantees a loan approval or better interest rates and terms. Credit score ranges vary based on the scoring model. A credit score is a number from to that rates a consumer's creditworthiness. The higher the score, the better a borrower looks to potential lenders. Average Personal Loan Rates by Credit Score ; Excellent (+). %, %, %, % ; Good (). %. %. %, %. particularly for loans within let's say years. It serves as a sort of market benchmark for where rates will be. Lenders can then add.

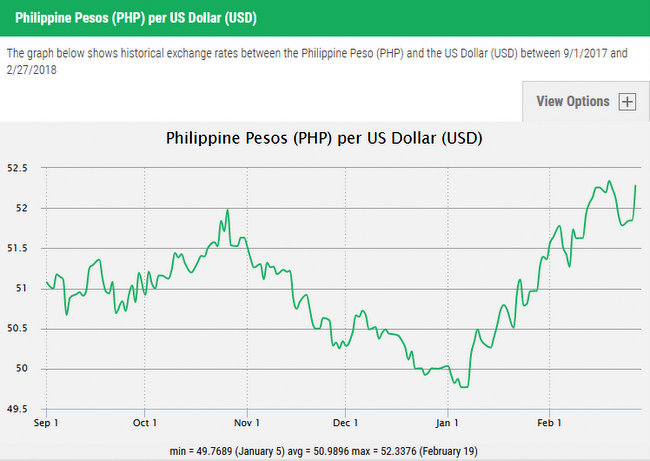

Exchange Rate Of Philippine Peso

1 USD = PHP Sep 05, UTC Check the currency rates against all the world currencies here. The currency converter below is easy to use and the. Rates are quoted in Philippine Peso. 3. For Preferred Banking Clients, please contact your Relationship Manager for special Forex rates. 4. All currencies. Philippine Peso, PHP, inv. PHP. US Dollar, · Euro, · British Pound, · USD to PHP | historical currency prices including date ranges, indicators, symbol comparison, frequency and display options for Philippine Peso. Convert Philippine Peso to Canadian Dollar ; 1 PHP. CAD ; 5 PHP. CAD ; 10 PHP. CAD ; 25 PHP. CAD ; 50 PHP. CAD. For instance, if the Philippine foreign exchange rate vs USD is at , this means that 1 US dollar can be converted into Philippine pesos. Download Our Currency Converter App ; 1 USD, PHP ; 5 USD, PHP ; 10 USD, PHP ; 20 USD, 1, PHP. In depth view into US Dollar to Philippine Peso Exchange Rate including historical data from to , charts and stats. Download Our Currency Converter App ; 1 PHP, USD ; 5 PHP, USD ; 10 PHP, USD ; 20 PHP, USD. 1 USD = PHP Sep 05, UTC Check the currency rates against all the world currencies here. The currency converter below is easy to use and the. Rates are quoted in Philippine Peso. 3. For Preferred Banking Clients, please contact your Relationship Manager for special Forex rates. 4. All currencies. Philippine Peso, PHP, inv. PHP. US Dollar, · Euro, · British Pound, · USD to PHP | historical currency prices including date ranges, indicators, symbol comparison, frequency and display options for Philippine Peso. Convert Philippine Peso to Canadian Dollar ; 1 PHP. CAD ; 5 PHP. CAD ; 10 PHP. CAD ; 25 PHP. CAD ; 50 PHP. CAD. For instance, if the Philippine foreign exchange rate vs USD is at , this means that 1 US dollar can be converted into Philippine pesos. Download Our Currency Converter App ; 1 USD, PHP ; 5 USD, PHP ; 10 USD, PHP ; 20 USD, 1, PHP. In depth view into US Dollar to Philippine Peso Exchange Rate including historical data from to , charts and stats. Download Our Currency Converter App ; 1 PHP, USD ; 5 PHP, USD ; 10 PHP, USD ; 20 PHP, USD.

Philippine Peso per US Dollar Exchange Rates: Daily Reference Exchange Rate Bulletin (RERB): Cross Rates. The Philippine Peso is expected to trade at by the end of this quarter, according to Trading Economics global macro models and analysts expectations. The Philippine peso, abbreviated as PHP in foreign exchange markets, is the national currency of the Philippines. Learn the history of the PHP. Monetary unit: Philippines ; Philippine Peso (PHP), 1 PHP, = ; PHP, = ; 20 PHP, = ; 50 PHP,. 1 PHP = USD Sep 05, UTC Check the currency rates against all the world currencies here. The currency converter below is easy to use and the. Conversion rates Canadian Dollar / Philippine Peso. 1 CAD, PHP. 5 CAD, PHP. 10 CAD, PHP. 20 CAD, PHP. 50 CAD, 2, US Dollars to Philippine Pesos conversion rates ; 1 PHP, USD ; 5 PHP, USD ; 10 PHP, USD ; 25 PHP, USD. Remitly offers dependable exchange rates for USD to PHP with no hidden fees. Join today and get a promotional rate of PHP to 1 USD on your first money. Foreign Exchange Rates ; THB, , ; TWD, , ; EUR, , ; CNY, , The highest US Dollar to Philippine Peso rate was on June 26, when 1 USD was worth PHP. What was the lowest US Dollar to Philippine Peso exchange. Current exchange rate US DOLLAR (USD) to PHILIPPINES PESO (PHP) including currency converter, buying & selling rate and historical conversion chart. %. (1Y). US Dollar to Philippine Peso. 1 USD = PHP. Sep. US Dollars to Philippine Pesos conversion rates ; 25 USD, 1, PHP ; 50 USD, 2, PHP ; USD, 5, PHP ; USD, 28, PHP. Enter the amount to be converted in the box to the left of Philippine Peso. Use "Swap currencies" to make United States Dollar the default currency. Daily Philippine Peso per US Dollar Rate ; 4, , ; 5, , ; 6, , Check live exchange rates for 1 USD to PHP with our USD to PHP chart. Exchange US dollars to Philippine pesos at a great exchange rate with OFX. USD to PHP. Historical Exchange Rates For United States Dollar to Philippine Peso · Quick Conversions from United States Dollar to Philippine Peso: 1 USD = PHP. Get the best Philippine peso exchange rate ; NM Money, You receive ₱51,, Exchange rate ; NM Money ❯ ; Sainsbury's Bank, You receive ₱50, Get information about the PHP currency. The Philippine peso (PHP), or 'piso' in Filipino, is the official currency of the Philippines. /09/ USD TO PHP TODAY Current USD to PHP exchange rate equals Philippines Pesos per 1 Dollar. Today's range: Yesterday's rate.